- Posted byadmin

- Tax Planning, Tax Deductible Expenses, Self Assessment, Personal Tax, Pensions, Employment, Company Cars, CIS, Capital Gains Tax, Financial Planning, HMRC, Investments, Inheritance Tax

- 0 Comments

746,000 People Fined for Late Tax Return - Are You One of Them?

The Self Assessment Tax Return deadline may have come and gone for 2018 but, if figures from the BBC are to be believed, then there are still 746,000 of you who are yet to submit theirs. You will have received a £100 penalty already but what now?

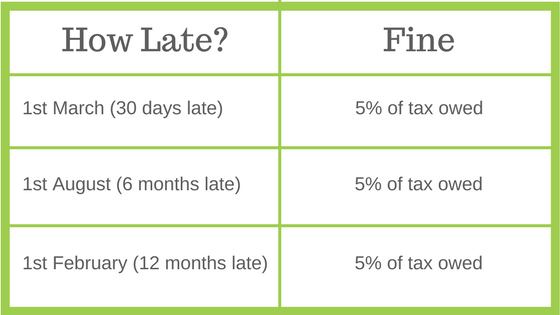

We have broken down the penalty fees for you below:

As well as receiving a penalty for missing the Self-Assessment deadline there are also penalties for paying your tax late. These are broken down below:

Let's try a simple example:

Jonathan thinks he owes a small amount of tax, lets go with a small round number like £100.

He misses the deadline and forgets about it for a few months. When he receives a letter he pops in a 'to do' pile and forgets about it again. A whole year goes by..... what does Jonathan owe now?

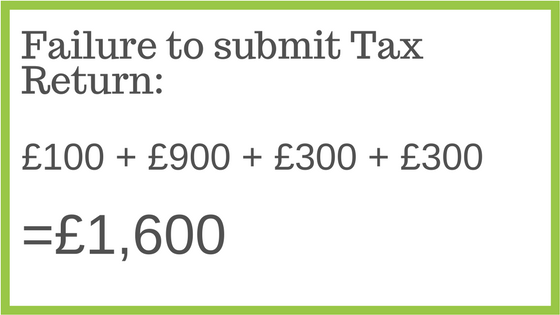

Lets look at the missed submission first:

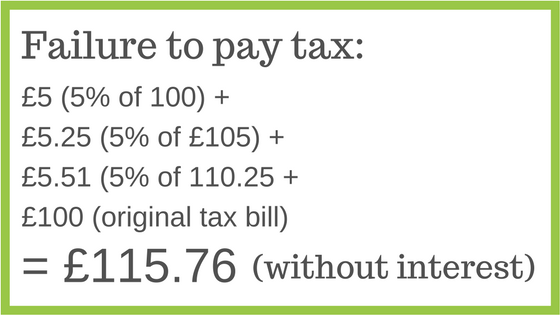

And now the missed tax payments:

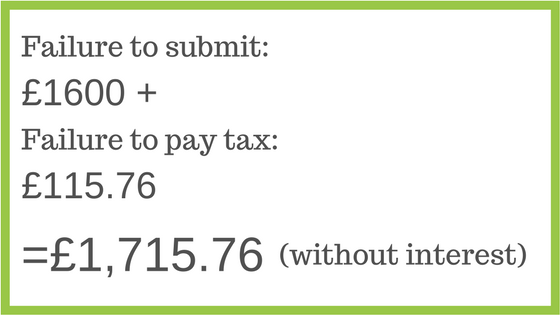

Ok. Lets add that together:

From a small sum of £100, Jonathan has got himself into a whole heap of trouble.

The moral of the story?

Don't be a Jonathan. Pick up your laptop or phone and get some help.

Even if you cannot pay your tax bill in time, submit your tax return. You can clearly see how much it will cost you otherwise.

Simply Tax will complete your tax return for a set price and in a fixed amount of time. Don't let it give you nightmares. Get that form submitted.

Photo credit to aboblist.com.