How does it all work? It's as easy as 1-2-3

Complete the form here on our website. This form will give us all the information we need to ascertain which price bracket your Tax Return will fall into. We will contact you to discuss your requirements and give you a fixed price. If you're happy with this price we will email you an Engagement Letter outlining the service we are about to provide and confirming the price. You will need to sign and return this letter, along with proof of ID. For new customers, we require payment in advance of the work being completed which is FULLY and IMMEDIATELY REFUNDABLE should the work not take place for any reason.

In order to comply with Data Protection we will set you up an account on our secure online document management system, IRIS Openspace. Here you can upload all your information - bank statements receipts, sales invoices, income details etc. We will complete your tax return on the basis of the information provided and send to you electronically for approval.

You will approve your Tax Return (or provide us with further information for amends). We will submit the Tax Return to the Inland Revenue.

GET IN TOUCH

-

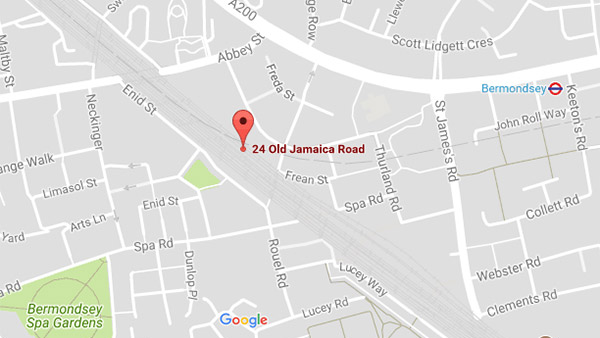

Unit 7 Fordwater Trading Estate,

Ford Road,

Chertsey,

KT16 8HG - Phone: 0208 434 7000

- Email: info@simply-tax.co.uk

- Privacy Policy