- Posted byadmin

- Tax Planning, Tax Deductible Expenses, Self Assessment, Property Tax, Personal Tax, Pensions, Employment, Company Cars, CIS, Financial Planning, HMRC, Investments, Budget

- 0 Comments

5 Ways to Better Organise Yourself for Self Assessment

As we slowly unwind after the Self Assessment deadline, now is the time to ask ourselves ‘how can I make Self Assessment easier next year?’ We have 5 ideas to help:

Receipt Bank.

Do you have a wallet full of receipts? Or a random draw stuffed full? Do you have to spend hours pulling them all out and manually inserting the data into a spreadsheet? Well now you can get rid of the paper and free your wallet with Receipt Bank. It’s so simple, all you need to do is scan or send a photo of the document to be processed by their software and it will publish the information to your cloud account. They have apps for both Android and iPhone so you can pop it into the software whilst out and about, throw the paper in the bin and completely negate the risk of losing it along the way. You can even include your whole team, using different access levels for different team members and creating different rules that tell Receipt Bank where you want the information stored for different transactions, suppliers and payment methods. Sound good? They even have a free trial on their website.

Consider a Business Bank Account.

Keeping your personal and business finances separate can help make things easier, especially when it comes to Tax Return time. Not only will you be able to see your business incomings and outgoings at a glance, but if you need to spend money on expenses, then you can use this account to do so.

It is a good idea to shop around when deciding which bank to choose. Your personal account provider may not be the best business choice. Whilst many banks do charge for a business account, some waive this charge if you pay in more than a certain amount each month. Many banks also boast offers for new customers; currently Barclays is offering 12 months free banking for new business customers.

Not only is it useful for organisational purposes, it can look more professional too. You can choose to use your trading name so that all payments are made to your business rather than your personal name.

Invest in Accounting Software.

Are you still messing around with Excel spreadsheets? Or perhaps even pen and paper? Whilst for some this is completely adequate, for most, an update to some accounting software can streamline your organisation and take the hassle out of your accounting. If you are thinking about flinging out the old notepad in favour of a new technology we can highly recommend Xero. With Xero you will not need to download any pesky software on to your computer, tablet or any other devices. It is all held in a cloud so you can log on anywhere, anytime. You can use the mobile app to send invoices or create expense claims on the go. You can send invoices online and see when your customers have opened them. You can even use their super fast bank reconciliation to import and categorise your latest transactions, manage your cash flow by scheduling payments or pay your staff with their payroll. They connect with over 600 third party apps including Receipt Bank that we mentioned above AND because we are a Xero partner, all our customers can receive a discount. Easy peasy.

Use a Tax Savings Account.

So, you're feeling pretty pleased with yourself, you have submitted your Tax Return on time without receiving any penalties but have you considered how much your tax bill will actually be? Or how you're going to pay it? Make it easy on yourself and start a dedicated savings account for your tax bill. HMRC even has a calculator you can use to help you estimate what you need to put aside. Pop a little away every month and you will be able to continue your smugness well into the new tax year. Again, make sure to shop around. Depending on how much your tax bill will amount to, you could even earn some interest along the way.

Hire an Accountant.

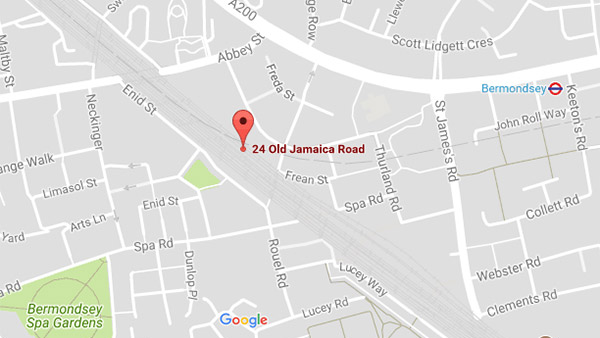

‘Well of course, you would say that’ we hear you tut but just hear us out. There are many benefits to having an accountant that surpass just having your tax return done for you (although just imagine the joy of handing your accounts to someone else instead of working through them yourself). Not only could you benefit from having a dedicated professional helping you work out what expenses you can claim for and the complexities of moving around your allowances to best suit you, your business and your family, but you could also benefit from having a experienced business consultant on your team. Someone who can divulge their years of experience with many different businesses, answer all of your queries and generally coach you through some of the tough decisions you as a business owner or sole trader will have to make. A good accountant will not only do this, they will do it for free. Like us, at Incisive we offer free business consultations to all of our customers. You can ask all the questions you want and we will answer them as best we can. We have staff that are trained in many different aspects of accountancy and business so you get the best answers, from the best people for the job.

If you would like more information then please feel welcome to check out the resources tucked away on our website such as our Tax Busting Checklist and our Introduction to Self Assessment.

So there you have it. Go forth and organise yourself and your business. Your future self will thank you for it.

Photo credit to Camilo Rueda López.